When we look back at the last five years in real estate, or the economy in general, it can be described as a “see-saw lustrum.” The English language is particular at times but misses the boat at others. Words for the passage of time are often varied and precise at the same time. For instance, a 10-year period is known as a decade; a 25-year period is called a quarter-century; a 50-year period is a semi-century or golden jubilee; and, of course, 100 years gets counted and mentioned all the time, as in the twenty-first century.

So, what is a lustrum, you ask? A lustrum is a less common term for a five-year period. Its origins date back to ancient Rome and refer to a purification ceremony that occurred every five years. The ceremony concluded the census — the counting of the population for military and taxation purposes. Luere means to wash (is that why the English call the bathroom the loo?) or purify, which was the primary purpose of the ceremony, including an animal sacrifice performed by a censor. The Romans truly lived in excess if they needed a reset or cleansing every five years.

As far as my “see-saw” reference, the last half-decade saw rapid change from one direction to another. Rapid movements in the market — down in 2020, up in 2021 and down again in 2022 — continued and so on. So much rapid change came in this short period, from one extreme to another, where we all experienced a wide range of emotions propelled by geopolitical and economic circumstances. Can this period be described as a time of great “lust,” as in the word lustrum? Hell ya! The longing for power, money and even living life to the fullest was heavily weighted in the first half of this decade. Remember all that “revenge spending” on our houses, on luxury goods, eating out and, of course, travel?

I’m not suggesting we are in need of a cleanse, though I do feel we just finished the first stage of the idiomatic seven stages of relationships with this century, out of the lust or passion stage and settling into the discovery or realisation stage. The latter half of the ’20s is a perfect time to launch into learning and unearthing the possibilities with more clarity and stability, away from the challenges, complications and noise of the past five years. With that emerges new concepts, ideas and expressions.

The Real Estate Word Cleanse

As a student of the real estate industry, I felt it was important to do my part to cleanse our industry of some of the words, myths and misconceptions that have impacted the first half of the roaring ’20s and culminated in 2025.

Mortgage Defaults

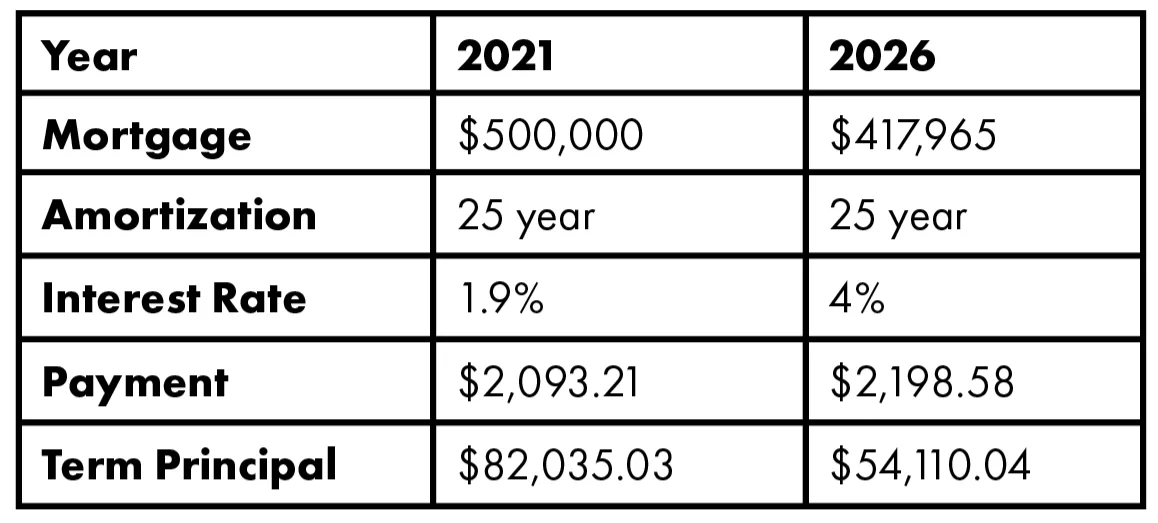

At the beginning of 2025, we heard a lot of chatter around rising mortgage rates coinciding with rising default rates. Particularly, those borrowers who got a mortgage in 2020 at below two per cent were expected to be shocked by their renewal payments as rates doubled. All those doomsayers shouted from the rooftops that homeowners in this circumstance were going to be walking away from their homes in droves.

CMHC just reported that the country’s national delinquency rates fell slightly in the second quarter of 2025 — the first decline in three years (though B.C. and Ontario were above the national average). Furthermore, the lower the interest rates, the more principal is paid down, which is a bonus at renewal. And if that isn’t enough to stop talking about mortgage defaults, let’s look at the numbers.

Incentives

In many parts of the country, housing starts are at an all-time low, and builders and developers are tired of sitting on the sidelines and want to get back into the market. History has a way of repeating itself, and builders and various levels of government have played a role in kick-starting new construction. Everything from development charge reductions, deferrals or rebates to eliminating HST on new construction for all buyers, not just first-time buyers. Builders can also impact the market with mortgage rate buy-downs, no-interest, non-payment second mortgages, closing cost credits, free upgrades, lease-to-own programs and short-term rent guarantees for investors.

Unfortunately for us in Canada, banks do not allow rate buy-downs, but the math is compelling. On a $1-million mortgage, to buy the rate down by one percentage point — from four per cent to three per cent — the upfront cost is $30,000 ($15,000 on $500,000), which gives the buyer $536 in monthly savings for the five-year term. This is a great way to bring affordability to the market. Can you imagine if buyers were allowed to withdraw from their RRSPs tax-free to do this, or if sellers could offer this as an incentive when selling their home?

Creative Financing

It’s time we explore more creativity when it comes to helping people get into and move up in the real estate market, creating financial instruments to avoid additional costs that drag on equity-building and affordability.

For instance, if there were a creation of a “market value second mortgage” made up of 10 to 20 per cent of the purchase price. Sellers or home builders could leave five per cent in the deal; parents could contribute funds within it; land transfer tax could be deferred and placed within it; in new construction, a portion of development charges and HST could be deferred and placed into this second mortgage. If the value of this second mortgage equalled 20 per cent, the mortgage would be conventional, there would be no insurance premium of four per cent added to the mortgage, and PST would not apply on the mortgage insurance ($1,600 on a $500,000 mortgage due on closing).

So how would this mortgage get paid, and how would it not burden the homeowner? The second mortgage is payment- and interest-free. Those entities that contributed would receive their money when the homeowner sells, and they share in the proportionate appreciation. So if the property appreciates 10 per cent after five years and the homeowner sells, then those in the mortgage receive 10 per cent on their share of the second mortgage.

Rentals

There is much to accompany the topic of rentals in 2026. Purpose-built rentals will remain a hot topic, but with more thoughtful unit mixes catering to different demographics. Family-sized units will be a marketing term; student rentals may lose their lustre as foreign student numbers are restricted; and senior-oriented rentals with some services — light health care, food service, cleaning services, etc. — will rise in prominence to fill the gap between a retirement home and a long-term care facility.

Modular Construction

Don’t quote me, but permanent homebuilding in various forms is over 10,000 years old, so why would modular home construction, which appeared in the early nineteenth century, be something we could adopt overnight? There are many naysayers who claim modular homes do not have legs. During the California Gold Rush, hundreds of homes were factory-made in the east and shipped west. In the 1830s, packable timber homes were shipped to Australia from London, England, to house British emigrants.

Don’t wait, Don’t miss!

What can I say about these superlative statements as someone who directly benefits from a booming real estate market? Can we really pronounce last rites on “won’t last long”? No more than the words “this house has loads of potential,” “motivated seller” or “fixer-upper.” The market is just that — the market — the last bastion of pure and unadulterated supply and demand. One thing is for sure: economic conditions can turn on a dime. A Q1 announcement of a trade deal or tariffs increasing for Canadian exports can move the housing market one way or another.

Is 2026 the Recovery Year?

I’ve always believed in the adage, “How you end the year, you begin it!” We have witnessed some remarkable events in the housing market as we round out 2025. New housing developments are being launched, sales in November have plateaued instead of showing their usual seasonal decline, and months of supply in some categories — particularly single-family homes — have come down 20 to 25 percent.

Surveillance Shopping

Also of note is the fact that showings per sale have never been as low as they are now for the month of November. It’s a phenomenon where buyers are becoming extremely familiar with the inventory and market nuances with the help of their real estate agents. As a result, they are making faster buying decisions. I refer to it as “surveillance shopping,” which I feel will continue to dominate the market in 2026.

When asked whether we should re-list or reduce the price, I’m in the reduce camp, because buyers are watching. Also, don’t refuse a sale with a conditional offer on selling the buyer’s home — especially if the home the buyer is selling is priced sharply to the market. A sale sends a message to those who are surveilling, which justifies the market price and can bring those waiting in the wings out of the shadows.

What is The Bank of Canada Telling Us?

The Bank of Canada estimates neutral policy rates between two and three per cent nominal, which translates into mortgage rates that are “normal” by historical standards but well above the ultra-low levels of 2020–21. In other words, the proverbial needle begins to move in the right direction for the economy and housing in nominal-rate territory, and we are currently at the lower range of neutral. Buyers who have been sidelined due to the high cost of borrowing now begin to enter the market, and the need to upsize or get into the market takes precedence.

One thing is for sure: the Canadian economy is due for a cleanse. As the economy proves resilient and begins a path to growth — no matter how nominal at first — so too will the real estate market. It always does.