By Conrad Zurini | Owner and Broker of Record

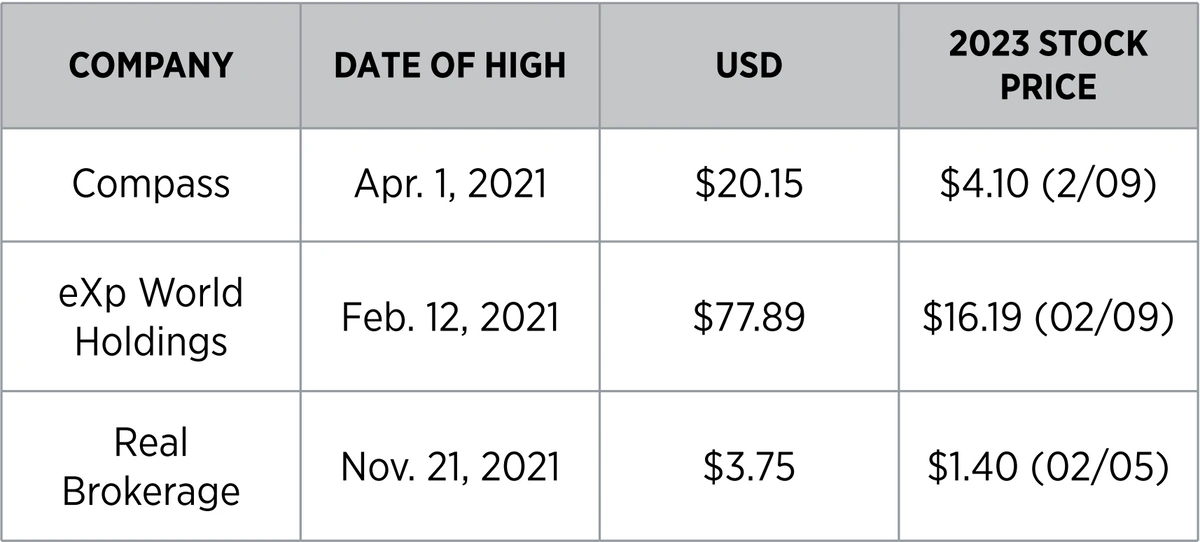

Conference season is upon us and my first conference of the year was Inman Connect in New York. January in New York is not my first choice, but a must go!! This conference at the beginning of the year set s a barometer on current sentiment, and a predictive tone for Q1and Q2 of 2023. Inman does a parade of real estate CEO fireside chat s, peppered with real estate influencers, and top agent opinions, tips and tricks. I particularly pay close attention to the CEO banter. Brad Inman has a unique interview style which politely puts CEO's on the proverbial hot seat and holds them accountable. True to Brad's form, he really put Compass founder Robert Reffkin's feet to the fire regarding his company's cash burn rate and stock plummet. What was once a mighty disruptor is now an uncertain player in the proverbial startup stock roller coaster club (see chart below).

What is interesting about our industry, (if I can be so industry-centric), is that many start-ups and company strategies are a response to an industry leader's bravado. I can remember back in early 2018 it was reported that Gary Keller took the stage at his family reunion and proclaimed that, We are a technology company. That was a response to Compass, a new entrant into real estate, which proclaimed they were tech forward, and had financial backing from Soft Bank. (Soft Bank primarily invests in companies in technology, energy, and financial sectors). RE/ MAX responded as well when they announced the very same year their tech acquisition of Booj. And later in 2018, eXp World Holdings acquired VirBela (another tech company), which is the backbone to eXp's cloud based platform. I'm still trying to figure out why eXp bought Success magazine at the end of 2020, but you get where I am coming from with CEO's entering into proverbial pissing contest's.

2023 is no different, and Inman opened up with the news that Co-Star was in discussions to purchase Realtor.com for an estimated $3 Billion USD. (CoStar Stock - Oct 15th, 20 21was $93.80 USD. On Feb 9th, 20 23 it was $77.0 4 USD). Rupert Murdoch purchased Move/ Realtor.com in 20 14 for $950 M. Not a bad return on investment, or is it? The debate on the floor was, did Realtor.com undersell or did Murdoch overpay for it in 2014? The real debate is what was Andy Florance (CEO of CoStar) going to do with this iconic brand? A year previously, Andy tried to buy CoreLogic for $770 M, but was rejected due to the acquired company's fear of potential anti-trust litigation. As it turned out, Florence announced he wasn't going through with the purchase of Realtor.com, and instead decided to scale up their current asset, Homes.com. He went on to say they will continue to actively access opportunities. I think it's time we all get familiar with Mr. Florance's next moves. He tried to buy something which we all use everyday (CoreLogic owns Matrix, our MLS® provider). Residential MLS® domination perhaps?

To Think Like a CEO or Not to Think Like a CEO?

Let's set the stage of where we are in business and technology today. Venture capital is drying up very quickly, and companies have an extreme desire to make money to prove their worth. Gone are the days (until the next wave of shiny object s), of investor money flowing into Proptech or Fintech, or any real estate startup for that matter, unless you can show you are making hard currency. Future potential profit s don?t mean a damn in this current climate, and no one want s to be the Peloton of their industry - a solution in the marketplace that takes off like a rocket during a unique moment in time, and fizzles out once things go back to normal. (Peloton traded on December 24th, 20 20, at $162.72 USD. On Feb 3rd 20 23, $16.28).

You Must Put Systems in Place to Weather the Cycles

I have always been a fan of the ARC Model of Innovation, which stands for Acknowledge, Reframe, and Connect. The popular notion of 'we are going back to basics' is one which is uttered by those who lack any creativity. It's a catch all when uncertainty reigns, like it has in the real estate industry over the last 280 days. Why 280 days? That's the human gestation period, and I believe that 9 months is just the right amount of time that it takes us as a species to accept, and modify our lives in order to absorb the disruption. If you analyze our disruptive market in 2022, it began to break in December/January, 9 months after the first interest rate increase back in March '22.

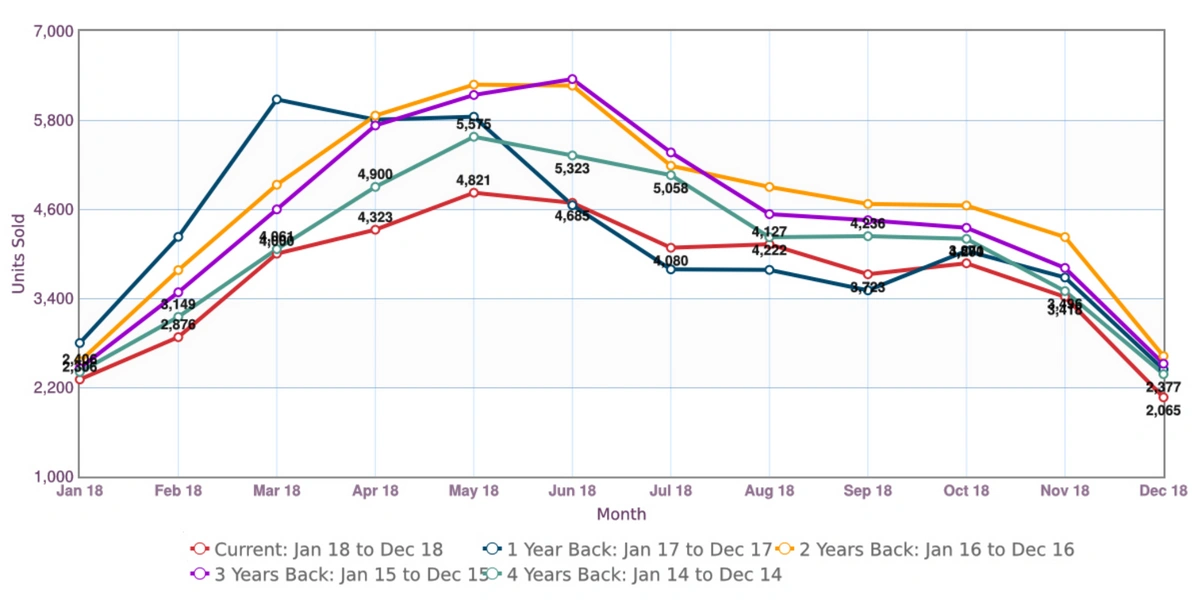

Another recent example of this 9 month theory is the 2018 real estate market in Canada. In January 20 18, OFSI (Office of the Superintendent of Financial Institutions), introduced the stress test for uninsured mortgages. This sent shock waves through the market in Canada. Below is a line graph of regional residential unit sales from 2014 to 2018. From January 2018 until September 2018, sales lagged behind '14, '15, and '16, and really didn't rejoin the previous 4 years' sales pattern until October, nine months after the major mortgage announcement.

What is the ARC Model of Innovation?

Now that the dust has settled when it comes to rising rates, and all indications tell us that there will be a long pause on rate hikes, it's time to plan for this so called new normal. The ARC model is something we should all be incorporating into our businesses. It's something we as a company have always embraced, consciously or subconsciously. It's time you examine all of your assets, your systems, your service offerings, your technology, your marketing etc., and apply the ARC method to them. It is important to acknowledge the current circumstances of the market, and reframe these circumstances within the context of your desired outcome. For example, one element of the current market is financial insecurity. It is beholden upon us to obtain a grasp on interpreting market statistics. Couple that data with the inner-workings of finance. By gathering this type of knowledge and connecting it to your client audience, they will, in turn be able to make better and quicker decisions, and drive sales.

Make a point of looking at your entire enterprise from top to bottom, and apply ARC to each individual plank in your business. Everything is on the table. Maybe it s time to go horizontal in your business by embracing a larger geographic territory, or another niche. And remember to always work on your business. We have a tendency to work in our businesses during a good market, and on our business when things become dire. Stop listening to and making bold statement s, but remember to always articulate your plans. By doing so you invite buy-in and/ or other point s of view, which will help you to refine your strategy before you execute upon it. And never, never worry about over communicating!!!!!

I Sign Up Everyone I Get In Front of

I hear this statement all the time, followed by a realization that there is a need to get in front of more people in order to grow your business. The good news is the flight to qualit y has never been stronger, and people love to hear about our business all of the time. So it s time you lean into who you are as a realtor, and who you are not. Consumers will see right through you if you are not genuine in your approach, they will be de-sensitized by the sameness of real estate social post s, and gone is engagement with stock photography on social. Remember, ?I do want to sell but I?m not ready yet? means they are pushing you away until they find the right house. So get them emotionally invested in a propert y that comes on the market. Find the gaps in their current home/ situation, and back fill their pain with a home that checks all of the emotional boxes.

More Good News

Our future isn't dependent on Q4 of 20 22 which represent s the worst quarter in real estate unit sales history. However, the watering hole (listing pool) is getting smaller. until we can figure out how to bring more inventory to the market, without segment s of the population feeling vulnerable. We must learn to deal with this so called new normal. Take the media company Thompson Reuters. News and media companies have been in revenue free fall for decades. Thompson Reuters Corp. just reported 'resilient financial result s to finish 2022' as reported in the Globe and Mail (February 10, 2023). They reported a 3% increase in revenues in the fourth quarter, proving their 2 year transformation to upgrade technology, services and improve the customer experience paid off. TR's main goal is to be able to 'weather any turbulence ahead'. When you go to their website, right at the top, in bold lettering it says, 'Make decisions with confidence'. World-class content and technology empowering today's most informed professionals? I wish I thought of that!!!!

Let's Shine a Light on Customer Experience

Recently, SuperOffice did a survey to find out what was a top priority in the next 5 years for businesses. 45.9% answered customer experience, with 20.5% answering pricing. The survey also found that 86% of buyers will pay more for a better customer experience. With the most important attributes of the customer experience being fast response times, knowledgeable people to help, and a real person to speak to, who had an ability to anticipate their needs.

Do you remember when you started in the business? You were attentive; you dropped everything to help your client; no one was a pain in the neck; you craved knowledge and you shared it with your clients, (World-class information to empower home buyers and sellers). Amazon and Jeff Bezos have embedded Day 1 into their company culture. It put's the customer at the centre of everything. We can learn a lot from this CEO. Bezos has articulated a battlecry which embodies the first day. Can you imagine if you could go back in time and create that same customer experience when you started in this business, and everyone and everything that happened to you was wonderful? Have you ever tried to go 24 hours without complaining. Imagine what that would be like.

If a mega company like Amazon can systematize a Day 1 philosophy, why can't you? It's time we all invest in our customer's experience, to bring that first day enthusiasm back to our industry. Today's consumers need and want us to be better, and we need to be better!!! Don't let the closure of Comfree/ Purple Bricks/ FairSquare give you a false sense of bravado. Companies/ business models will come and go in our industry. We all need to look at what we do, and plan for its relevance in 10 years. In other words, focus on what is not going to change in the next 10 years, and build your business around it. Remember to educate and inform. Focus on having more interactions than ever before with your clients, and stop relying too heavily on automation to supplement too much of your client's experience.