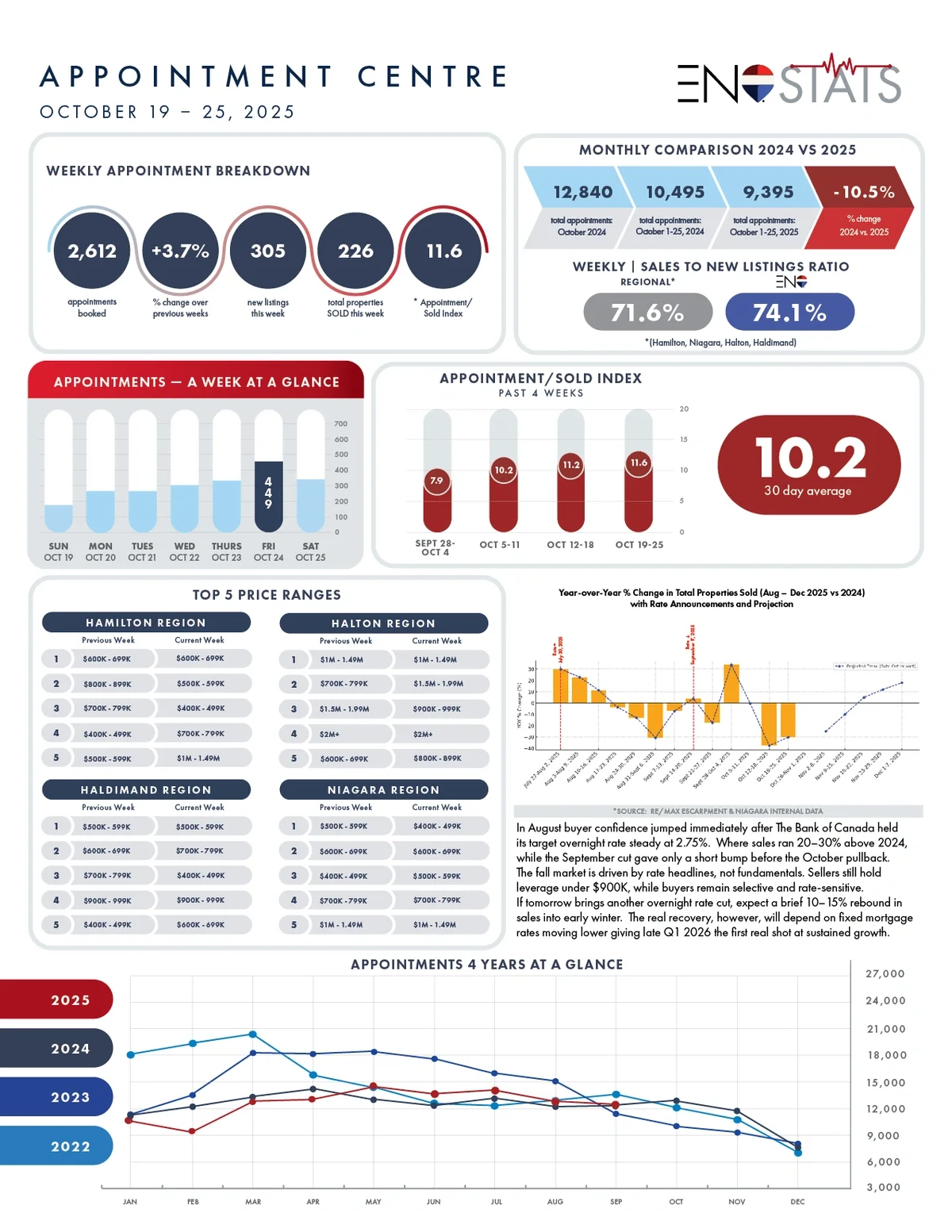

In August buyer confidence jumped immediately after The Bank of Canada held its target overnight rate steady at 2.75%. Where sales ran 20–30% above 2024, while the September cut gave only a short bump before the October pullback.

The fall market is driven by rate headlines, not fundamentals. Sellers still hold leverage under $900K, while buyers remain selective and rate-sensitive.

If tomorrow brings another overnight rate cut, expect a brief 10–15% rebound in sales into early winter. The real recovery, however, will depend on fixed mortgage rates moving lower giving late Q1 2026 the first real shot at sustained growth.