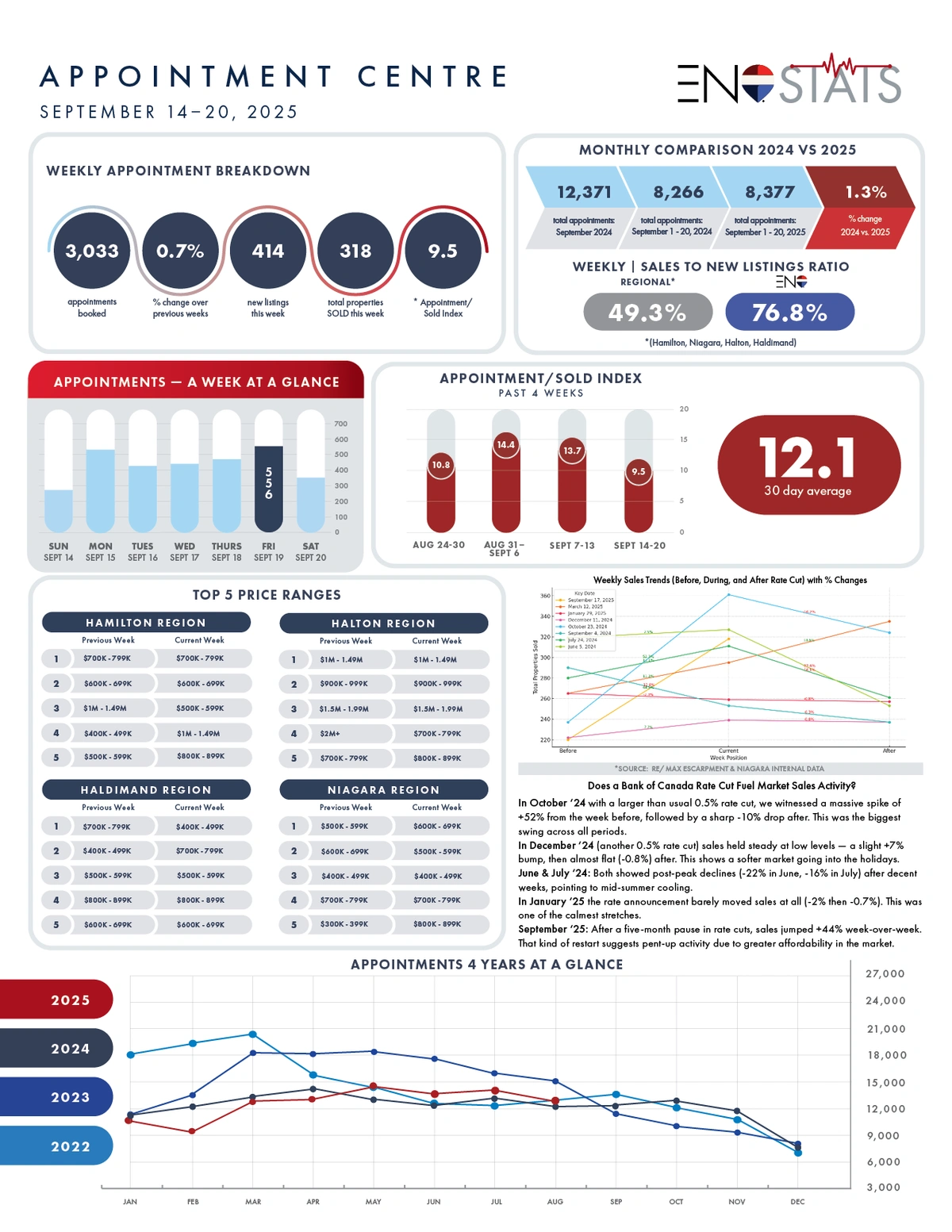

Does a Bank of Canada Rate Cut Fuel Market Sales Activity?

In October ‘24 with a larger than usual 0.5% rate cut, we witnessed a massive spike of +52% from the week before, followed by a sharp -10% drop after. This was the biggest swing across all periods.

In December ‘24 (another 0.5% rate cut) sales held steady at low levels — a slight +7% bump, then almost flat (-0.8%) after. This shows a softer market going into the holidays.

June & July ‘24: Both showed post-peak declines (-22% in June, -16% in July) after decent weeks, pointing to mid-summer cooling.

In January ‘25 the rate announcement barely moved sales at all (-2% then -0.7%). This was one of the calmest stretches.

September ‘25: After a five-month pause in rate cuts, sales jumped +44% week-over-week. That kind of restart suggests pent-up activity due to greater affordability in the market.