Recently I had a craving for Chinese food. It reminded me of when I was a kid and I so looked forward to opening the fortune cookie. My parents would have to hide the cookies from us kids because we would always want to open them right away. At the time these messages were so cryptic for us kids, I’m not sure if the act of finding this secret message had more impact on us than the actual message itself. So when did this cookie adventure, so to speak, become synonymous with Chinese cuisine? Would it surprise you to find out that this cookie with a message inside was believed to be from Japan, and was made of sesame and miso, and were sold near temples in Kyoto, japan.

These cookies were first introduce in San Francisco by Makoto Hagiwara who served them in his tea garden in the early 1900’s. Then along came David Jung, a Chinese immigrant and founder of the Hong Kong Noodle Company, claims to invented the fortune cookie in 1918 and inserted encouraging messages for unemployed men on the streets of Los Angeles. Ironically during this period in the United States there was an influenza pandemic, extreme weather conditions and droughts and there was a world war. Does this sound the least bit familiar? Covid-19, followed by devastating fires and torrential rains, followed by a global trade war.

My nostalgia to re-live my childhood wonder became the best of me, and now that I’m an adult I can break that cookie open and pull out that fortune slip before I devour my chicken fried rice. I read my fortune aloud to the small group around me, and not one of them believed what it said, and they all were certain I made it up. “You are the master of every situation”, I uttered with uncertainty, then with confidence I read it again, “You are the master of every situation!” What are the chances of getting that very message, was it some sort of divine sign during this time of uncertainty. So I went down the rabbit hole of AI and Google to see if this particular message was common. All were cautiously unanimous in their answers, which is expected by AI sources, however, they all had a sentiment of rarity to it. ChatGPT felt it was “unusually assertive and bold” for a fortune cookie, with most messages like “You are in control of your destiny”, or “Now is the time to try something new”, or “Confidence will lead you forward” are more common place.

History has a strange way of repeating itself and we find ourselves again in very uncertain times, or are we? How did we get out of this uncertainty before, did we count on the government, luck, or an act of fate? No, we dug deep and counted on ourselves, our talent, our strength and our will to succeed. As one third of 2025 comes to an end, so may our sense of uncertainty. My father told me “I always learned from my mistakes, and the more expensive the mistake the better the lesson.” I truely liked the expression, to never waste a good crisis, and not that we are deep in crisis but we are in a time of flux, and we can learn so much from our federal election and the topsy-turvy nature of the financial markets.

Yours To Lose

Nothing illustrates this phrase more than the federal election in Canada, this year’s Masters, and (don’t get me started) the Leafs’ (3-0) lead in the first round of playoffs. By the time this blog is published we will have the results of the election, the Leafs advance, and this phrase will either be poignant or pathetic. If you followed this year’s Masters you would have witnessed the personification of yours to lose, with Justin Rose leading after the first day with -8, all he had to do was come back the next day and do 75% worst than the first day (-6), 65% of his effort on the third day to get -4 and 50% for the last day -2, and he would have made history at -20. I know it doesn’t work that way but when you apply numbers to it, it just seems doable.

When we started this election journey, the Conservatives had a very commanding lead, and it looked like we were going to see a coronation rather than an election. The political pundits are attributing this loss of ground by Poilievre as his failure to transition from Opposition Pit Bull to Prime Minister in waiting. Once you build a persona like Poilievre did, it is difficult, but not impossible to transition. We see this in our industry all of the time where a successful agent will transition into talking about the mistakes that other agents make, or showcasing agent training, or doing a spoof video to showcase a new listing. When a realtor does this they confuse their client base, who have come to know that agent as a realtor who is all about being a real estate professional who is about helping them purchase and/or sell their largest and most important asset. In other words…what are you going to do to sell my home? Why are you the expert I need in a difficult market? What is your track record of success and how can you demonstrate it? And BTW, your sidebar side hustle as a restaurant critic or a downline recruiter doesn’t equate to real estate proficiency.

Winning Elections/Clients 101

1. Create a Consistent and Controlled Message

Being consistent with your message is paramount, and remember the service you provide for your clients must be easily recognized. Don’t be clever, be direct and concise. I’m not saying that you should not AB test how you frame your message, but it has to be one of consistency. As far as how to control your message there are several channels. YouTube pre-rolls allow you to put content in front of consumers based on their browsing history and interests. Instagram reels allow for controlled targeted content to be absorbed by consumers, and carousels allow users to swipe at their own pace.

2. Always Have a Strong Crisis Management System

Things can always go wrong as a Realtor and as a Politician, it’s important to have every scenario and a plan and messaging around it. Recently the Liberals had a candidate which had some questionable commentary about the opposing candidate which was severe enough to take action. Carney was slow to re-act and his communication on the matter was weak, a rookie move. In real estate we come across core crisis on a regular basis, like a seller leaving debris at a home on closing day, a showing agent leaving a door open at one of your listings, you as a professional should have all the scenarios documented and your process to deal with them. Your clients/voters will judge you on how quickly and exacting you respond to a crisis, and will be quick to discount you when you fail.

3. Have Targeted Content for Your Current Clients (Supporters) and Prospects (Undecided)

Segment your database and create avatars (profiles) for each of your client (voters) by doing so you can format content that speaks to that audience. Your database segmentation will mirror the broader community, and you will be able to attract like-minded consumers with similar goals who will become aware of your unique skill set to solve their problem and/or to move them forward.

4. Celebrate Every Win and Share Success Stories

Our primary job is to get the people we serve and represent to share incredible stories of our contribution to their success. One of the ways we can do that is to take time to celebrate their wins, and in-turn they will tell those stories to their circle of friends, business associates and family. Wins can be measured in various ways, the one which has the greatest impact is when you give context to the win. As a politician you can attribute economic growth compared to your predecessor or crowd size at a political rally compared to your opponent. As real estate agent you can show how you helped garner offers higher per square foot, than all the homes in the immediate neighbourhood in the last 6 months.

5. Drive Engagement and Calls To Action

This is where you create shareable ‘a ha’ moments which pinpoint a client/voter’s deeper needs. By deconstructing complex issues and providing some sort of tool for consumers/voters to see how it benefits them. For instance de-mystifying the bond market and how it affects long term mortgage rates with a link to a mortgage calculator which compares variable and long term rates, with an ability to enter forecasted rate cuts or increases, coupled with real estate market value growth or decline, to help evaluate the risk and/or reward of getting into the market at a specific time.

What Happens When We Are Richer Than We Think?

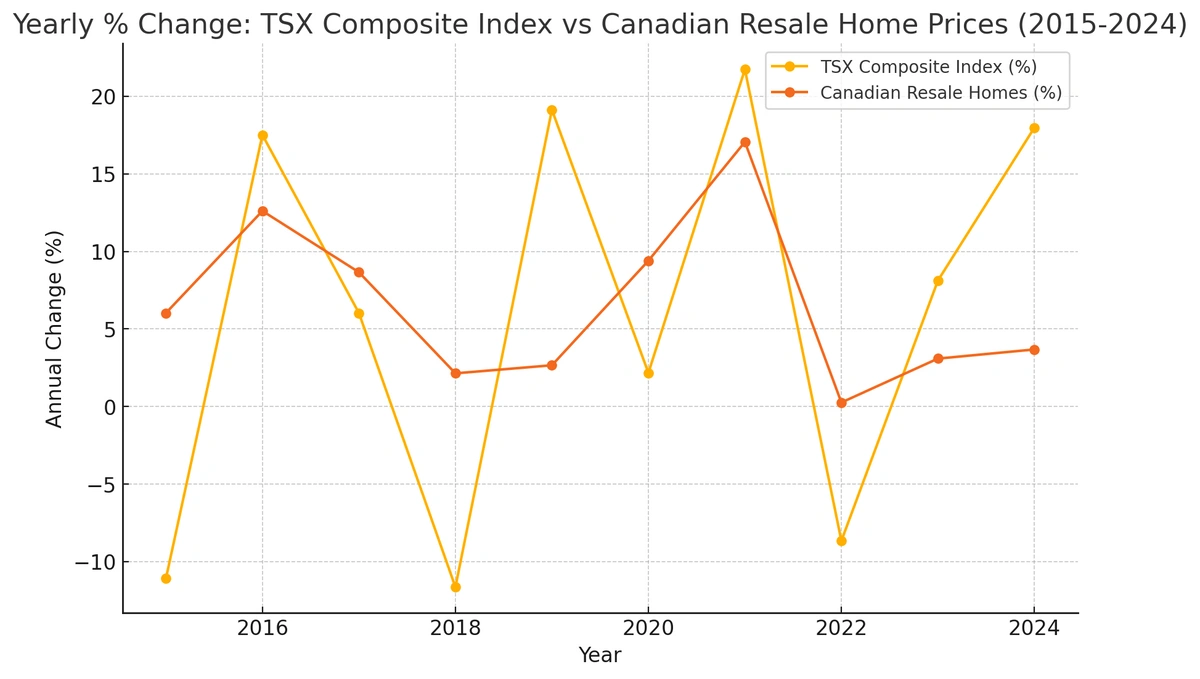

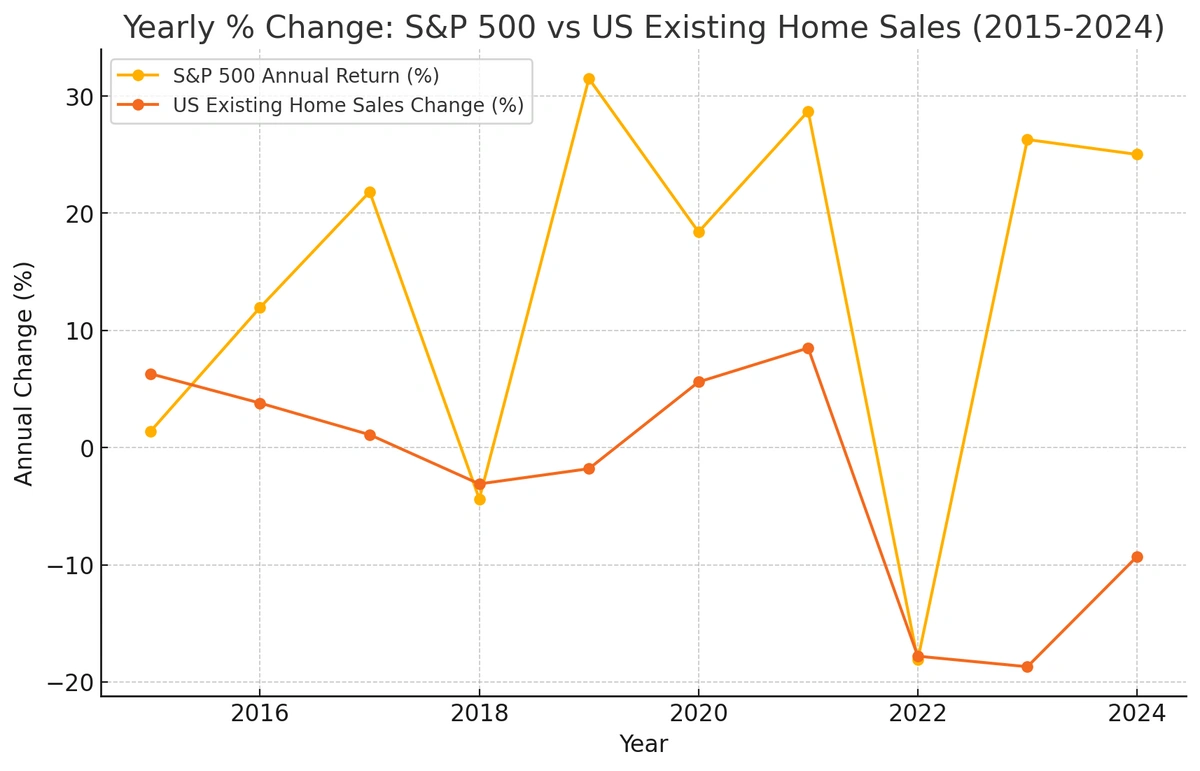

There has always been an anecdotal correlation between the stock market and the real estate market. Is it that if our stock portfolio is performing well, we bring that confidence to real estate? Or is it when our stock portfolio is waning, we tend to focus on real estate investing? So much has been written as to which type of investing is the clear winner over time, I will let you, the reader, delve into that. The focus here is on how these two investment vehicles intermingle, and how the past performance of these indices are the tea leaves of the future. Undoubtedly, the financial markets at the end of Q1 of 2025 were in turmoil, and tempered the real estate market in its wake. The first graph compares the TSX Composite Index against Canadian Resale Home Prices and the second graph compares the annual change in US Existing home sales versus the annual return on the Standard and Poor’s (S&P) stock market index. Without question you can’t live in a mutual fund, and we all need shelter of some sort, let’s establish the fact/fiction that our principal residence is a form of investment, and for most Canadians (Americans) it is our largest.

The TSX Composite Index shows higher volatility with huge swings up and down, while home prices remained more stable. The stock market does react faster and with more decisive loses and gains, and of course housing cycles are much longer, but you can’t deny there is a mirroring effect, even if it is slightly delayed. Real estate shows more stable returns and does not experience the explosive growth inherent in the stock market. While both markets are sensitive to economic cycles there is a co-relation between the two, time will tell how Q1 economic turbulence will affect the housing market.

While the stock market is highly sensitive and more foreward thinking, investors can react in real-time to things like inflation, interest rates, employment, and corporate data. Both the S&P index and existing home sale fluctuations show some correlation by moving in the same direction with the positive and negative directions of the broader economy. Furthermore, the higher mortgage rates of post Q1 of 2022 and pressure on affordability has widened the gap between these two asset classes in the US.

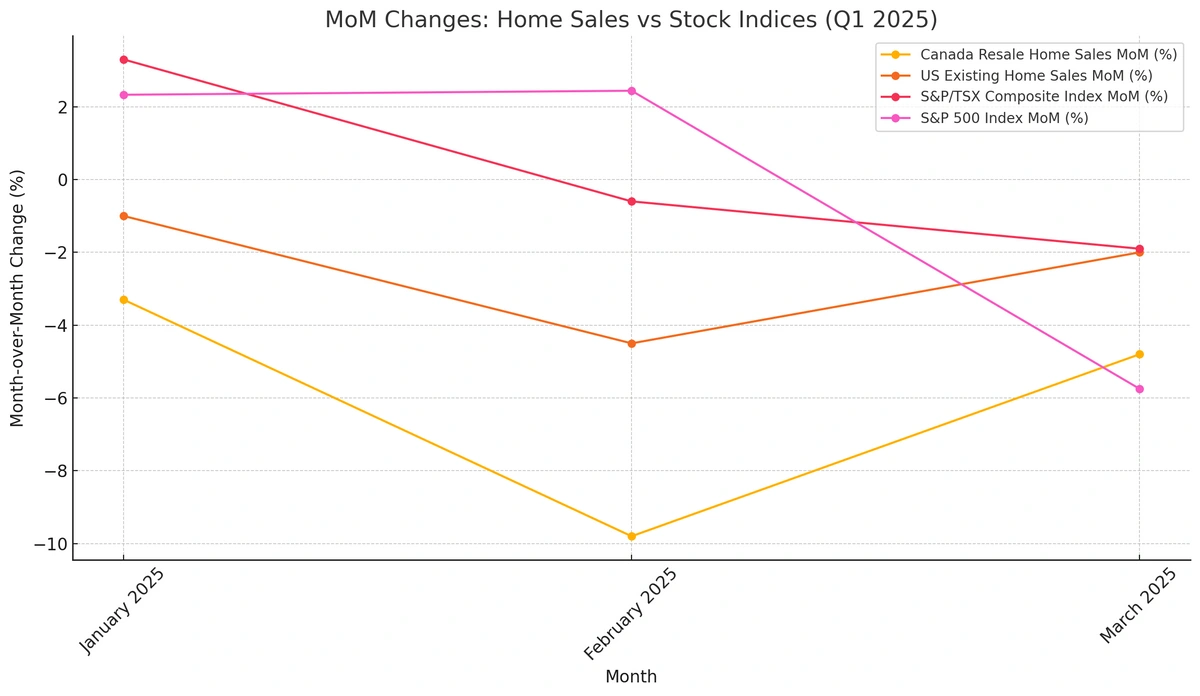

What A Difference a Quarter Makes?

While a quarter doesn’t make a whole, it can give us some indication of what will happen once stability is brought to both markets. As in the above chart these markets move in similar directions. Early 2025 started with exuberance in financial markets post US election. But by February/March, the on again, off again, on again tariffs played with investor confidence and resale home sales began a recovery from the steep drop in February. As calm comes to all markets the rest of the year can prove to be what it was meant to be all along, one of recovery. Stability is on the horizon for both countries, as we Canadians elect a new government to tackle the uncertain ‘trade’ winds before us. And, the American and Canadian industrial complex begins to adjust to the “New Deal” (rules of import/export engagement). The path to certainty is upon us and will reflect well as the year progresses. First and foremost it is up to us as professionals to highlight the opportunities for our client’s short, medium and long term needs, by keeping on top of every economic indicator which affects consumer sentiment.