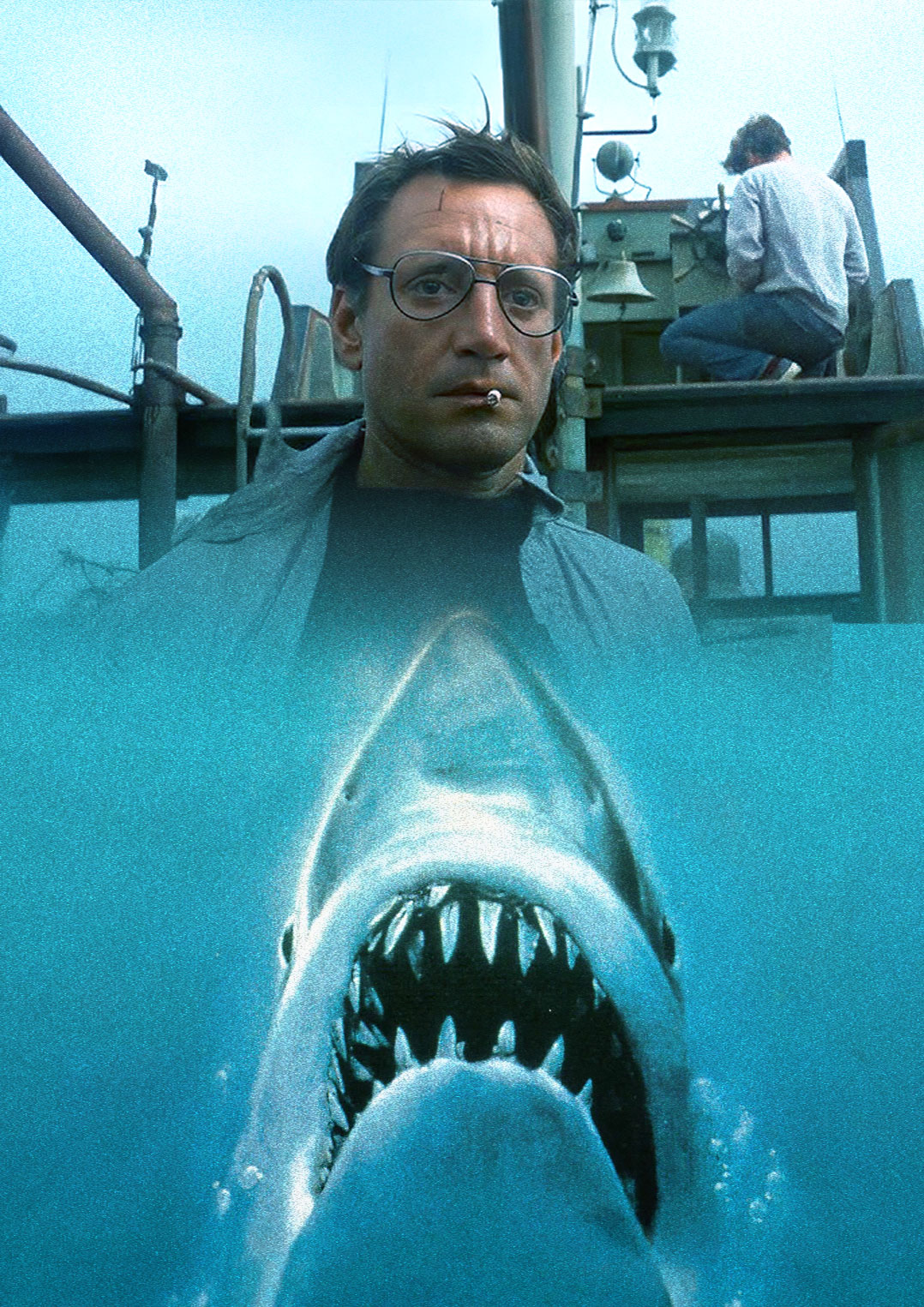

The Summer of 2025 for me was an absolute perfect blend of warm summer days, great conversations over Hugo Spritzes. Work wise things went at a very nice pace, and quiet contemplation turned into a robust thought process. While the real estate market locally came to life this summer, where we at RE/MAX Escarpment and Niagara saw a healthy 15% increase in unit sales over July of 2024, agents were busy, mortgage specialists seemed optimistic, and lawyers breathed a sigh of relief that closings were starting to increase after a slower than normal spring market. I wish I could incorporate a sound affect at this time as all seems to be going tickadeeboo, but what comes to mind is that scene in Jaws 1 (released in 1975) when the ocean is calm and Roy Scheider who played Police Chief Martin Brody, got a brief but impactful glimpse of Bruce (the name of the mechanical shark prop used in the movie) aka Jaws, and said “You’re gonna need a bigger boat.”

Whilst I would love to have summered in Martha’s Vineyard where the movie Jaws was filmed, to stare down the mouth of a great white shark, “my shark” so to speak came from 3 separate instances this summer. One, was Porsche CEO admitting that his company’s business model does not work. Two, was Berkshire Hathaway’s $5 billion write down on underperforming Kraft Heinz. Three, was the colossal shut down and embezzlement of trust funds by the discount brokerage iPro Realty in Ontario. As a business owner, the response to these canary’s in different coal mines does not lie in getting a bigger boat, they lie in getting a smarter boat; one that is more nimble, one that optimizes performance from the crew, the boat that is fuel efficient and can still make a big splash.

Wake-up Call #1 - “Our Business Model Doesn’t Work”

Oliver Blume, long time CEO (circa 2015) of Porsche, circulated a company memo stating that ‘our (Porsche’s) business model no longer works.’ What is really astounding by this commentary is that Porsche’s first quarter sales in North America in 2025, was their best quarter in history. Porsche’s first quarter deliveries in the US were nearly 19,000 vehicles, representing a 40.6% increase year-over-year. With that great success came a price increase, which Porsche announced in July of 2025 ranging from 2.3% to 3.6%, representing the second price increase in the last 4 months.

So what are we all missing, and what does this have to do with my business? In order to answer that, lets do a deeper dive into what is occurring at this remarkable auto brand which is ranked the #1 most valuable luxury brand (8 years in a row), above Chanel, Louis Vuitton, Rolex, and Ferrari. The top reason for ‘the sky is falling’ memo is that Porsche’s largest customer growth engine (China) shrank by a mere 42% year-over-year in the first quarter. Porsche’s overzealous goals to go electric, may have confused its client base. I ask, does the typical Porsche customer want to be just seen and not heard…I think not. Another threat to this switch to EV is the fact that China has created their own EV auto industry which is more technologically adanced and far less expensive. Sometimes you just can’t stand on the shoulders of your brand of performance and handling, without the juxtaposition of excelleration and the roar of a combustion engine.

This new era of automobiles is all about high tech and high value. It’s about re-deploying resources in the combustion engine into high quality finishes, useful options, and next level technology. You see, Porsche forgot its brand promise of sexy sounding cars that performed, and poured a lot of money into EV’s which may have confused their customer base. As a result, Porsche is forced to look inward to adjust its business model to restore profitability in this uncertain era of the automobile. The lesson here is never take your customer base for granted, and assume that they will follow you whatever direction you decide to take.

Wake-up Call #2 – Everyone One Knows ‘It Has To Be Heinz’… Except the Consumer

From Erin Brockovich, to Once upon A Time In Hollywood, to Home Alone, to South Park – Kraft Dinner probably ranks up there with CocaCola for product placement in movies. Nonetheless, Heinz ketchup, the Kleenex of condiments, “the taste that’s worth the wait,” has fallen out of flavour. Is it because they changed their recipe or their logo like the beloved Cracker Barrel? Or was there an indiscretion between the CEO and an HR executive at a Coldplay concert? No, it was just that store brands have been taking marketshare in food and condiment categories, because mac and cheese/ketchup is easily replicatable, which Heinz tried to refute with its slogan “it has to be Heinz”. The lesson here is you just can’t only rely on your established presence in your marketplace.

Wake-up Call #3 – The Rise And Fall of A Large Discount Brokerage

For those of you who were away in August and may have missed it, there was a company called iPro Realty, which was the 5th or 6th largest brokerage by number of agents in Ontario with over 2500 real estate agents, became insolvent. The ownership used trust account money (buyer’s/tenant’s deposits for future property purchases/leases) to keep their business afloat. The owners of iPro allegedly paid back investors and subsidized their operations by using money that didn’t belong to them. By the time our sleepy regulator (Real Estate Council of Ontario) noticed the trust cash register was down approximately $8,000,000.00, it was too far gone and had tarnished the trust of the industry and the dismissal of the head of our regulating body. The lesson here is there are going to be failures in your category of business. Your response should always be what measures are you going to take to prevent your own failure, and how to rebuild your own industry due to their gross mismanagement.

Sound the Alarm – The Tide Is Too High

Each one of these situations are like your alarm in the morning. It goes off once and you hit snooze, it goes off twice and you hit snooze again, by the third time you wake up ready to take on the world. If these circumstances were separated by months instead of weeks they probably would have gone unnoticed, and would have been a part of the regular news cycle. But when a company of the stature of Porsche admits its survival is in question, I take notice. And when a series of products which are a part of all of our lives day in and day out begin to pile up financial losses, I pay attention. And when a real estate brokerage in my back yard takes a fall of such epic proportions, I give heed.

Where Business Meets The Big Blue Ocean

Our businesses are built to withstand choppy waters. We have the team, the resources and equipment on board to help navigate uncertain waters, but sometimes we are lulled into the complacency of calm seas, so in order to make sense of these three successive occurrences, I will yield to a sailors expression handbook for the answers.

Batten Down The Hatches – Take Control of Rising Operational Costs

All Hands On Deck – Employee Optimization and Asset Repositioning

Ship-Shape – Always Operating in A State of Transparency

Fair Winds And Following Seas – Always Be Aware of Market Pressure and Demand Shifts

Between the Devil and the Deep Blue Sea – Not Adopting Technology and Innovation

Square-Rigged, and Squared Away – The Case for a Strategic Reset

Headwinds – Regulatory and Macroeconomic Uncertainty

Know the Ropes – Stay In Your Lane